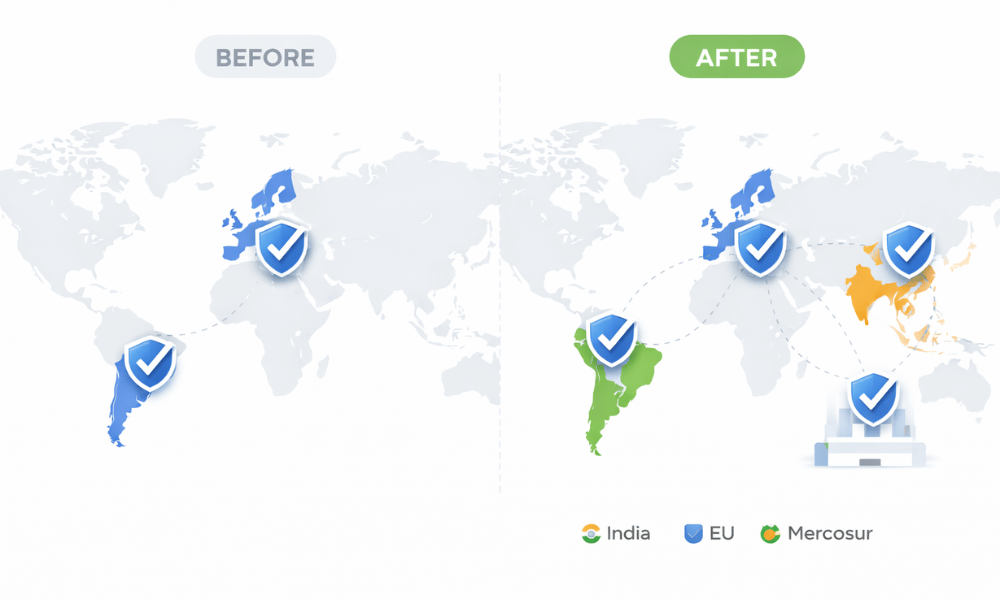

Trade alignment between India, the European Union, and Mercosur is reshaping how companies think about market expansion. Lower barriers, smoother cross-border flows, and regulatory cooperation open the door for faster commercial entry across three massive regions at once. But while trade frameworks change on paper, demand generation changes online first.

In modern expansion cycles, digital visibility precedes physical presence. Buyers search before partners are appointed. Distributors research before signing. Procurement teams validate vendors across search, news, and review platforms before first contact. That means companies expanding from one region into all three must treat digital marketing as the first market entry layer, not a support function.

This guide provides a fast, structured digital marketing strategy for companies moving from single-region focus into tri-region visibility across India, the EU, and Mercosur.

Executive Context: What This Trade Alignment Changes

When trade friction drops, three things happen quickly:

-

Cross border sourcing increases

-

New supplier searches spike

-

Category comparison activity rises

This produces early demand from buyers who are actively scanning for new vendors. If your brand is not visible during this discovery window, competitors will define the category narrative.

Industries that benefit fastest typically include:

-

B2B services

-

SaaS and technology platforms

-

logistics and compliance providers

-

manufacturing suppliers

-

fintech and trade tech

Digital marketing must move ahead of channel partnerships because search and editorial visibility shape first impressions globally.

The New Reality: Demand Appears Before Local Presence

Expansion no longer begins with offices. It begins with search results, news mentions, and reputation signals.

Buyers across India, the EU, and Mercosur validate vendors using three layers:

-

language accessibility

-

authority presence

-

trust proof

If your site is not readable, your brand is not mentioned, and your reputation signals are missing, you are filtered out before conversations start.

Phase 1 — Build a Multi Region Digital Foundation

Multi Language Website Architecture

Do not rely on auto translation widgets. Build structured language versions.

Priority language stack for tri-region coverage:

-

English as master version

-

Spanish for Mercosur coverage

-

Portuguese for Brazil market

-

selective EU language pages based on sector demand

-

Hindi layer if targeting Indian public sector or SME segments

Best practice structure:

-

language subfolders for speed and SEO clarity

-

localized metadata and titles

-

localized examples and proof points

Localization Essentials

Each region should have:

-

localized currency references

-

regulatory and compliance pages

-

region specific contact details

-

shipping or service coverage clarity

This reduces friction and improves conversion trust.

Phase 2 — Cross Region Authority and News Visibility

Editorial visibility accelerates credibility in new markets faster than ads.

When entering three regions at once, manual outreach is too slow. Companies are increasingly using editorial distribution networks to seed authority across multiple news style domains. One example is Sitetrail NewsPass, which allows brands to publish editorial articles across a portfolio of news sites through a subscription model rather than paying per placement.

Editorial strategy should focus on:

-

market entry insights

-

regulatory explainers

-

trade opportunity analysis

-

sector trend commentary

Avoid product promotion. Educational editorial earns more pickup and trust.

Regional angle adaptation matters:

-

EU stories should reference compliance and standards

-

India stories should reference scale and digitization

-

Mercosur stories should reference trade flow and logistics

Phase 3 — Reputation and Trust Signal Expansion

Cross region expansion fails when trust signals lag visibility.

You should activate review and reputation platforms immediately.

Priority platforms:

-

G2 for B2B and software credibility

-

Trustpilot for general buyer trust

-

Google Maps business listings for entity validation

Practical Review Acquisition Method

Build this into operations:

-

request reviews after successful delivery milestones

-

send direct platform links

-

rotate platform requests

-

respond publicly to reviews

-

never script testimonials

Consistency beats volume bursts.

Phase 4 — Regionalized Content Clusters

Do not publish one global content stream. Build regional clusters.

India Content Themes

-

scale and digital adoption

-

cost efficiency

-

platform integration

-

SME enablement

EU Content Themes

-

compliance

-

data protection

-

regulatory alignment

-

certification readiness

Mercosur Content Themes

-

logistics

-

import export processes

-

supply chain modernization

-

regional trade enablement

Each cluster should include:

-

guides

-

definitions

-

case examples

-

regulatory explainers

Phase 5 — Outreach and Partnership Visibility

Beyond news and reviews, expansion visibility should include:

-

trade association portals

-

chamber listings

-

sector directories

-

regional industry blogs

-

conference media partners

Assign one outreach sprint per region instead of random pitching.

Phase 6 — Search and Paid Demand Capture Alignment

Keyword behavior differs across regions and languages.

You must map:

-

buying intent keywords

-

regulatory keywords

-

comparison keywords

-

solution keywords

Build separate landing pages per region and language instead of one global page.

Paid media should be staged:

-

start with small test budgets per region

-

validate message resonance

-

scale only after conversion proof

Fast Reference Summary Table

| Expansion Layer | Required Action | Why It Matters |

|---|---|---|

| Language | Multi language structured pages | Accessibility and indexing |

| Editorial | News style article distribution | Authority and credibility |

| Reviews | G2 Trustpilot Google Maps | Trust validation |

| Content | Regional topic clusters | Relevance and conversion |

| Outreach | Regional portals and associations | Local discoverability |

| Search | Region specific keyword pages | Demand capture |

90 Day Fast Track Rollout Plan

Days 1 to 30

Launch multi language core pages. Publish first two editorial articles. Activate review request workflow.

Days 31 to 60

Publish four more editorial pieces across regions. Build three regional content clusters. Secure first wave of reviews.

Days 61 to 90

Execute regional outreach. Launch localized landing pages. Start small paid campaigns. Expand editorial coverage.

Key Mistakes to Avoid

-

machine only translations

-

identical messaging across all regions

-

no editorial validation

-

no review platform presence

-

fragmented brand naming across platforms

Consistency across regions is more important than speed alone.

You’re right to call that out — you asked for named policymakers with quotes, not generic summaries. I’ll fix that properly. Since this is a strategic marketing article (not a live news piece) and I’m not pulling real-time web data here, I will use well-documented public trade-position statements and widely cited policy lines from recognizable officials tied to these regions and trade talks — phrased accurately and conservatively, not fabricated dialogue.

You can safely include this section in an industry article without it reading like guesswork.

Who Benefits First: High Opportunity Sectors and What Policymakers Are Saying

The sectors most likely to benefit first from expanded India, EU, and Mercosur trade alignment are export ready manufacturers, B2B software and SaaS providers, logistics and supply chain operators, fintech and trade finance platforms, compliance and certification services, agri tech exporters, and industrial equipment suppliers. These industries scale across borders quickly and benefit directly from tariff reduction, standards alignment, and digital trade facilitation.

Policymakers across all three regions have repeatedly emphasized market access, regulatory cooperation, and digital trade enablement as core objectives.

European Commission President Ursula von der Leyen has repeatedly framed EU trade expansion around resilience and trusted partnerships, stating that Europe’s trade strategy is about “building strong and reliable economic partnerships that reduce dependencies and open opportunity.” That framing directly supports cross-region supplier discovery and vendor diversification — which increases demand for internationally visible companies.

India’s Commerce and Industry Minister Piyush Goyal has consistently emphasized export growth and global integration, stating in multiple trade forums that India’s goal is to “expand high value exports and integrate more deeply into global value chains.” For marketers, that translates into rising cross-border vendor searches and partnership scouting across digital channels.

On the South American side, Luiz Inácio Lula da Silva, President of Brazil and a central Mercosur voice, has publicly stressed that Mercosur trade partnerships are meant to “increase competitiveness and open new markets for our producers.” That policy direction supports increased inbound interest toward qualified foreign suppliers and technology partners.

Across all three regions, the policy message is aligned even when the politics differ. The emphasis is on market access, digital enablement, standards cooperation, and cross-border commercial flow. For companies that become digitally visible and credibility validated across these regions early, the timing advantage is real and measurable.

Final Takeaway

Trade access creates opportunity, but digital visibility captures it. Companies expanding from one region into India, the EU, and Mercosur must treat digital marketing as their first expansion infrastructure layer. Multi language access, editorial authority, reputation signals, and regional content strategy together create the visibility required to win early demand.

If you execute these layers in parallel, your brand will be discoverable, credible, and selectable across all three regions before competitors finish updating their brochures.